In an era where efficiency and speed are paramount, the debate between postal and electronic payments continues to surface. Old habits may die hard, but businesses worldwide are gradually shifting to modern, innovative approaches such as electronic payment systems. This article covers the basics of postal and electronic payments and the compelling rise of the latter in the business world. Also, we delve into why electronic payments reign supreme over conventional postal payments, how to ensure secure transactions, and a glimpse into the future evolution of electronic payments.

Understanding Postal and Electronic Payments: The Basics

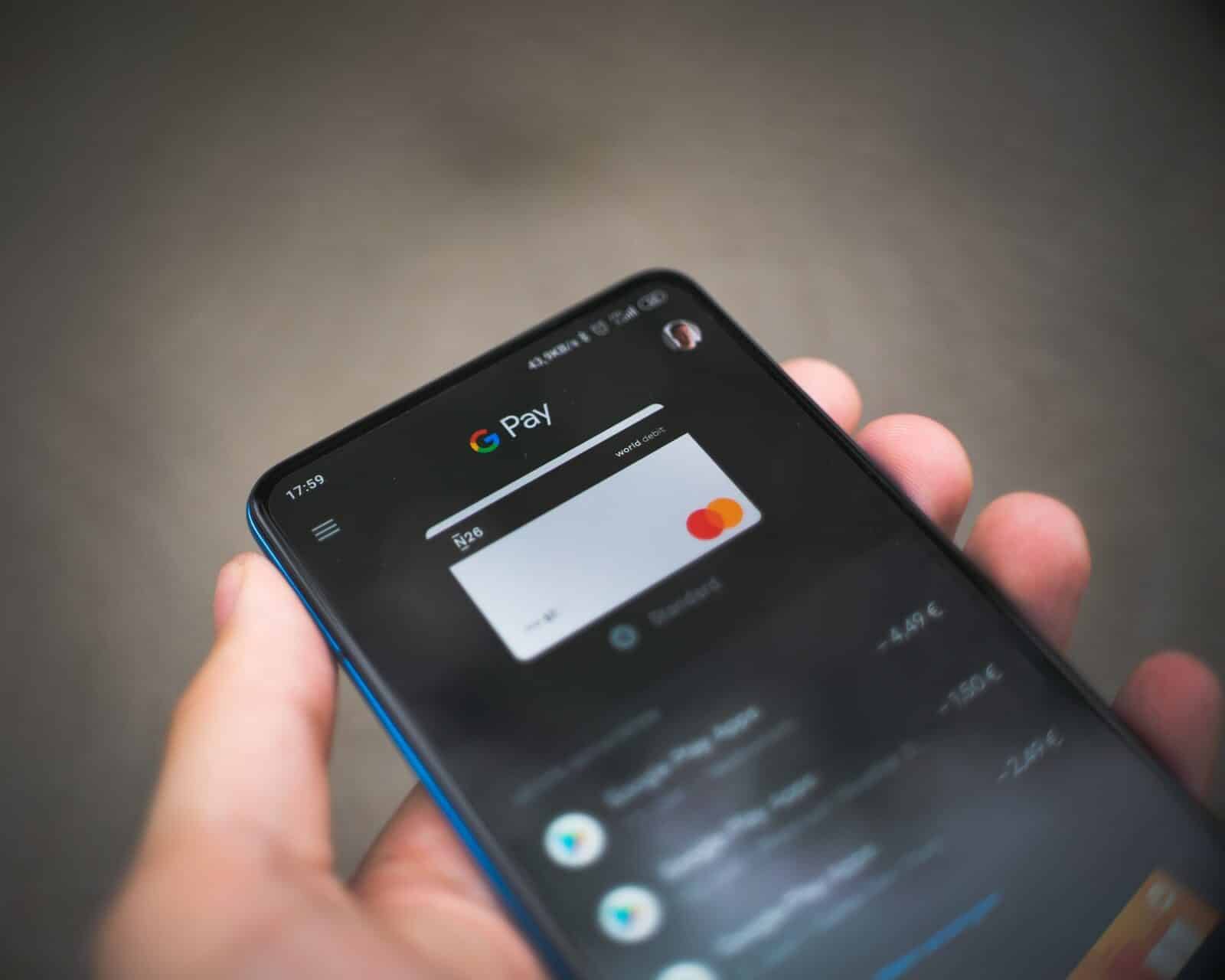

Before delving deeper, let’s familiarize ourselves with the terms. Postal payments typically involve sending checks or money orders through mail. The process, albeit reliable, can be slow and cumbersome. On the other hand, electronic payments comprise of transactions done digitally using debit cards, credit cards, or any digital wallets like PayPal or Google Wallet. The overwhelming convenience and speed make electronic payments favorable in the modern world.

The Influential Rise of Electronic Payments in Business

The business landscape is experiencing an undeniable shift to digital platforms. Consequently, electronic payment modes have seen increased acceptance and implementation. The reasons are manifold. Foremost, businesses can receive funds in real time, facilitating instantaneous transactions and simplifying accounting. Additionally, they offer versatility in accepting payments from around the globe, thereby expanding business horizons.

More so, transitioning to electronic payments shows an enterprise’s commitment to staying current. Shoppers are embracing the digital revolution, and businesses keeping pace will not only solidify their credibility but also foster customer engagement.

Grasping the Advantages of Electronic Over Postal Payments

Businesses are recognizing numerous benefits of electronic payments versus traditional postal payments. Here is a comprehensive overview of the advantages:

- Time Efficient: Electronic payments eliminate time spent on manual handling of cheques and money orders.

- Cost Reduction: Lower handling and postage costs contribute to significant savings for businesses.

- Improved Cash Flow: Instantaneous transactions lead to better cash flow management and predictability.

- Less Prone to Theft: Electronic payments provide better security against theft, as funds are transferred directly between accounts.

Overcoming Challenges: Ensuring Secure Electronic Payments

While the shift to electronic payments appears beneficial, it brings along its own set of challenges. One significant concern is the heightened risk of cyber threats and fraud. However, numerous payment systems tackle this issue by incorporating advanced security features. These include end-to-end encryption, multi-factor authentication, and regular audits to ensure the security of transactions.

It’s crucial that businesses keep systems updated and educate themselves on emerging threats and safety regulations. By being proactive, businesses can safely harness the potential unleashed by electronic payment systems.

Future Forward: The Evolution of Electronic Payment Systems

As we forge ahead in this digital era, electronic payment systems continue to evolve and develop at an unprecedented speed. The industry growth forecast is promising, with advancements like Blockchain, Biometric authentication, and AI-powered automated systems driving the future. Electronic payments, with their multitude of conveniences, are here to stay and undoubtedly will influence the future economic landscape.

With these innovations, the case for transitioning from postal payments to electronic is compelling. The key lies in adopting these systems judiciously and staying updated on the emerging technologies and trends.

In conclusion, the digital transformation of businesses invariably involves a shift towards innovative, efficient, and secure methods of transactions such as electronic payments. The superiority of electronic over postal payments is evident in terms of time efficiency, cost reduction, improved cash flow, and greater security. However, businesses must remain vigilant against the rising tide of digital threats and fraud. As electronic payment systems relentlessly evolve, enterprises must stay in sync with emerging technologies and trends, and select the right platform for their needs. One such convenient, comprehensive and highly secure solution they can turn to is Online Check Writer.

With the ability to connect with over 22,000 banks and manage payments seamlessly from one platform, Online Check Writer revolutionizes business transactions. The platform allows you to pay or get paid instantly without transaction fees, and comes integrated with major accounting and payroll software. Used and trusted by over 1 million users, Online Check Writer provides a single space for all your transactions, enabling you to focus more on your business. Not only does it offer a secure platform for transactions, but it is also voted as the best check printing software in 2021. Don’t stay mired in traditional ways of handling payments when a digital revolution awaits you – sign up with Online Check Writer today!

Don’t miss our latest Startup guide: Evolution in Payment Methodologies: From Postal Checks to Online Transfers