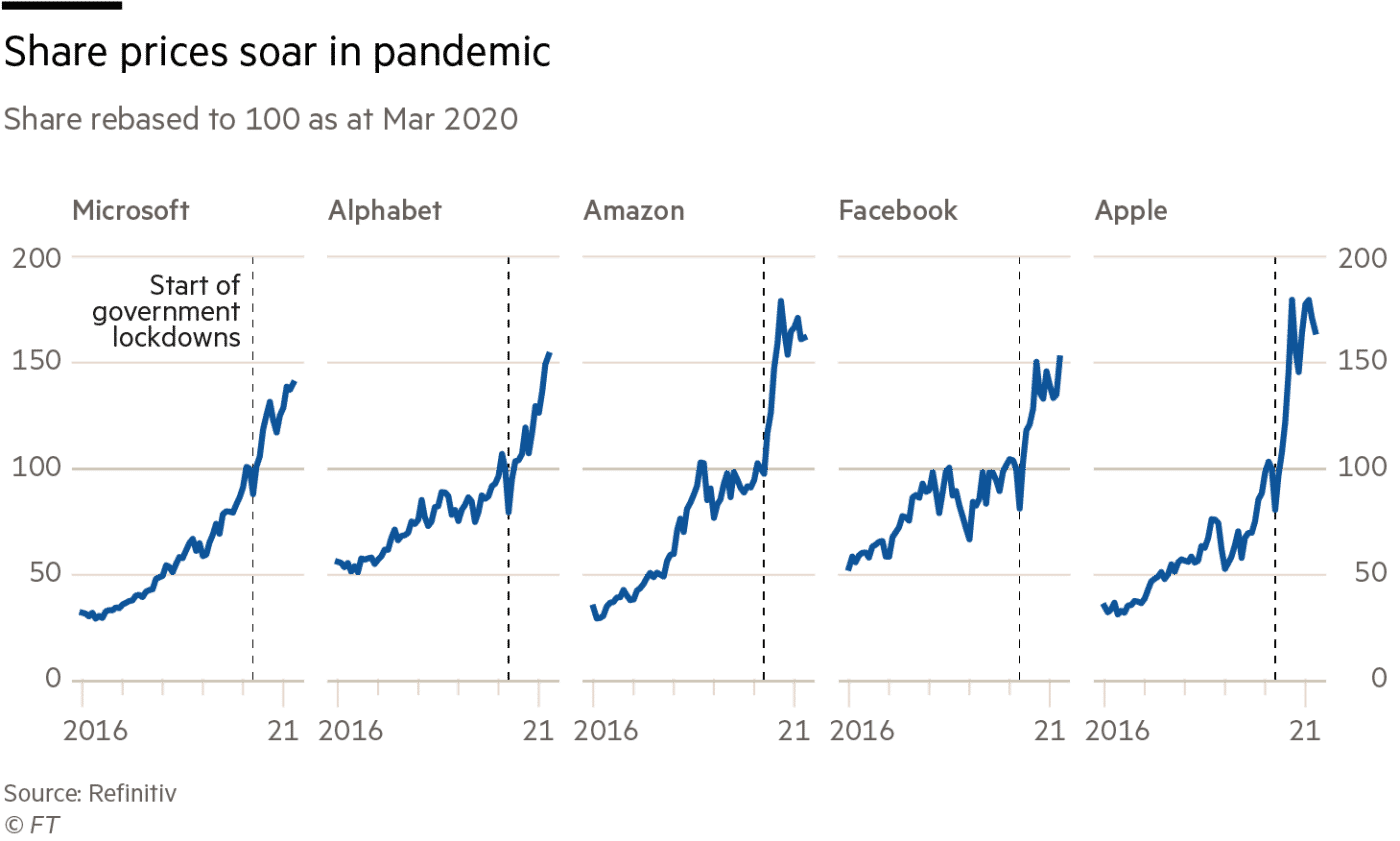

After the world’s largest tech companies enjoyed a boom during the coronavirus pandemic, it was expected that life would gradually return to normal. But it certainly did not turn out that way.

Big Tech has reported a surge in growth and profits that stunned Wall Street. This delivered powerful evidence that the digital dependence forced on a large part of the world’s population over the past year could have an enduring effect.

Some tech investors and analysts said that the outsized figures point to a reset in the business world. According to this view, the leading digital powers have combined their gains from the past 12 months and made themselves an even more indispensable part of work and personal life.

Impact of numbers

Big Tech’s increasingly outsized impact on the world of business can best be summed up by just two numbers.

One is the combined revenue of Alphabet, Amazon, Apple, Facebook, and Microsoft, which jumped 41 percent in the first three months of this year, to $322bn. That points to a growth rate that the leading tech companies have not seen in years, even as they have become some of the world’s biggest companies.

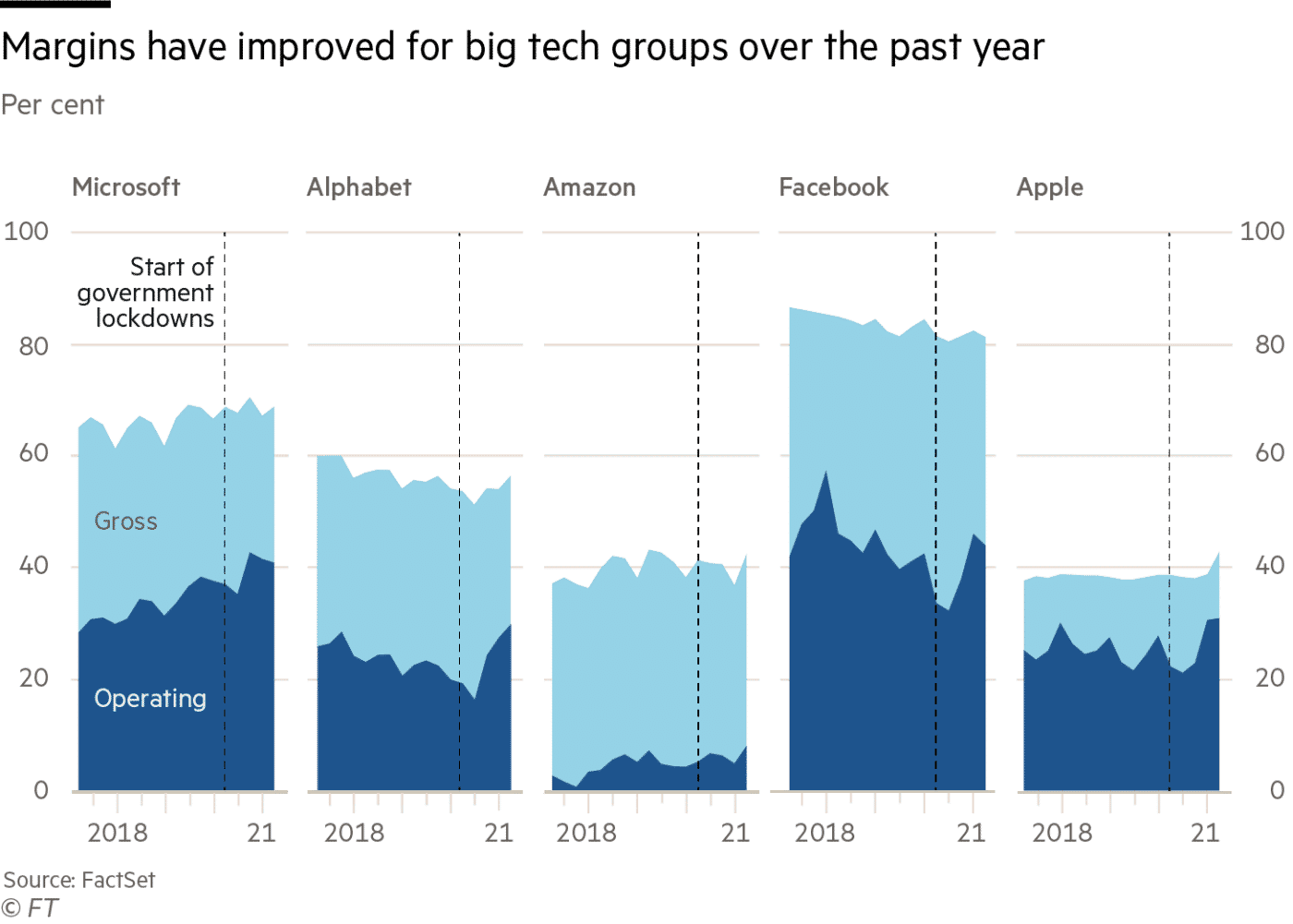

The second is the companies’ profit growth, which has been even more spectacular. After-tax earnings for the five companies soared by 105 percent from the previous year to $75bn. Profit margins rose strongly across the sector, as the biggest companies benefited from the economics of scale while keeping a wary eye on cost expansion during the pandemic.

Pandemic, dependability, and new market standards

Tierney said that Wall Street already appreciated the defensive power of the tech stocks, believing them to be resilient to the worst of the downturn. He further added that a fact that was less understood until recent days, was that Big Tech is poised to lead the way out of recession as well, as consumer and business activity surges across their digital platforms.

All companies but Apple were growing by more than 10 percent before the pandemic hit, though their growth rates had been decelerating.

Gene Munster, an investor at Loup Ventures said, “Consumers once valued choice, but what they value now is dependability”. That has led them to concentrate their attention and spending on a handful of familiar, easy-to-use platforms like the iPhone, Google’s search engine, and Facebook’s Instagram, he added. The reason is that habits became deeply ingrained as screens came to play a central part in all facets of life.

Whatever the reason, the first anniversary of the pandemic has been marked by an across-the-board leap in both activity and monetization on the largest digital platforms. Barring a reversal as the world reopens, that has set a new and higher bar for the tech companies to be measured by.

“The question is, how high is the new plateau?” said Brian Wieser, head of business intelligence at GroupM, part of advertising group WPP. “It’s certainly higher than we expected two weeks ago.”

Digital advertising for regulating sales

A handful of areas show stellar first-quarter performance. Digital advertising has jumped sharply. The most widely-used mobile and cloud computing platforms, from the iPhone to Amazon’s cloud services, have seen a new burst of activity.

“Pre-pandemic, we were seeing a deceleration in digital advertising growth, but the pandemic has juggled a lot of things,” said Wieser. Brand owners saw digital advertising in a new light as businesses became more dependent on online sales, he added. Many new businesses formed over the past year have turned naturally to online channels to find a market.

Google and Facebook each registered their strongest advertising growth for years, with Google’s ad revenue increasing 32 percent and Facebook’s leaping 46 percent.

The existing strong consumer base for steady growth

In spite of all this, the expansion of the cloud computing platforms run by Amazon, Microsoft, and Google, which have become a mainstay of corporate IT departments, has made fewer headlines. Meanwhile, the tech companies have taken advantage of their deep ties with millions of users to extend their reach deeper into some of the services delivered over their platforms. Apple’s move into services contributed to a profit jump that lifted its gross profit margin to more than 42 percent from the steady 38 percent over many quarters.

New services have brought about a transformation in Amazon’s profit profile. That includes the growth of the Amazon Web Services cloud platform, as well as advertising. The result was a record quarterly profit for a company once notorious for its persistent losses. Amazon’s $8.1 billion in after-tax earnings in the quarter was equivalent to the company’s net earnings in its entire first 22 years of existence.

But for how long can these companies keep their profits up to such big numbers is a big question. To answer it in simple words, There’s no sign of them hitting the wall yet.