Pegasystems Inc., a leading provider of low-code platforms, makes a significant stride in retail banking by enhancing its Pega Smart Dispute™ software. The new enhancements in Pega Smart Dispute™ employ Pega Process AI™ technology to streamline the time-consuming chargeback processes in retail banks. This innovation aims to make decisions smarter, save time, money, and effort, thereby accelerating the resolution of transaction disputes and fraud claims for customers.

Pega Introduces AI-Driven Chargeback Efficiency

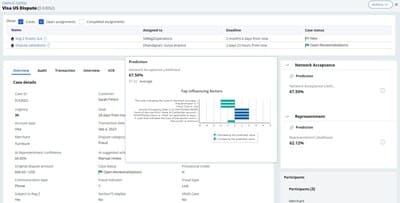

By integrating Pega Process AI within Pega Smart Dispute, the software can automatically analyze a transaction dispute to predict the likelihood of approval through validation rules of payment networks like Visa. This crucial information allows banks to map out an efficient and low-cost path to resolution. The added intelligence also enables banks to automate cases with a high chance of success and delegate more human resources to cases with a lower probability. This innovative approach not only brings down labor costs but also ensures faster resolution for customers.

Benefits and Features of Pega Smart Dispute

The combination of Pega’s industry-leading workflow automation, real-time AI-powered decisioning, natural language processing (NLP), and complex event processing empowers Pega Process AI to optimize and automate business processes. Simple and effective, this AI-infused technology rapidly resolves cases by using data-driven, AI-infused arbitration. The continuously learning nature of Pega Process AI enhances prediction and decision accuracy every time. Clients around the world currently employ Pega’s AI engine to make hundreds of millions of decisions daily.

Addressing Rising Chargebacks with Pega Solution

The uptick of chargebacks globally has increased the pressure on bank staff, a situation further compounded by surges of regulation and fraud in the post-pandemic world. Thus, banks need efficient solutions to tackle these challenges. Pega takes on this issue by seamlessly incorporating its secure and scalable AI into the Pega Smart Dispute solution to streamline process flows, increase employee efficiency, and heighten customer satisfaction.

In conclusion, the latest enhancements to Pega Smart Dispute are poised to bring about a revolution in retail banking, particularly in the management of chargebacks. The added AI capabilities will not only streamline the dispute process but also aid in predictive decision making. All these benefits combined promise to save both time and costs for banks while improving their customer service.

Don’t miss our latest Startup News: Huawei Leads the Charge in Intelligent Education Innovation