Generally, South Asian businesses face many obstacles trying to raise early-stage growth funds. They struggle to secure a working capital loan from traditional financing institutions. They are also very reluctant to sell their equity at such an early stage. This is where the Singapore-based financing startup Jenfi comes in. Jenfi provides revenue-based financing of up to $500,000 with flexible repayment plans. Co-founder and chief executive officer Jeffrey Liu refers to this as the “growth capital as a product”.

A little about the financing startup Jenfi

Revenue-based financing is gaining traction in many other markets. However, Singapore-based Jenfi is the first company of its kind focused on Southeast Asia. The startup announced today that it has raised a $6.3 million Series A led by Monk’s Hill Ventures. Participants included Korea Investment Partners and Golden Equator Capital, 8VC, ICU Ventures, and Taurus Ventures. The company previously raised $25 million in debt financing from San Francisco-based Arc Labs.

Jenfi works primarily with “digital-native” companies, including SaaS providers and e-commerce sellers. Some of its clients include Tier One Entertainment, Pay With Split, and Homebase. Jenfi hasn’t disclosed how much non-dilutive financing it’s provided so far. But its goal is to deploy $15 million by July 2022.

The aggregate sales of companies in its portfolio are currently more than $30 million. Furthermore, Jenfi expects that the capital it has already deployed will help them generate $47 million in sales or a 156% increase by July 2021.

How Jenfi came to be

Liu and Justin Louie found the financing startup Jenfi in 2019. They saw how traditional financial institutions were lagging behind Southeast Asia’s digital boom. Jenfi’s creation was motivated by some of the challenges Liu and Louie faced while financing a high-growth startup focused on Asian markets.

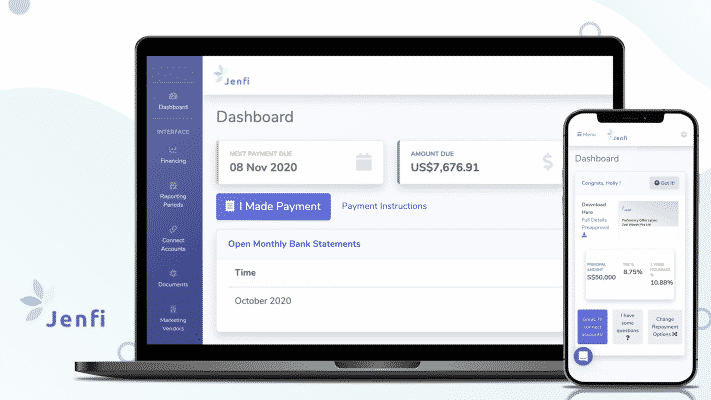

Jenfi’s application process is completely online. In some cases, companies have received financing in less than 24 hours, although it typically takes a few days. This is another benefit over traditional working capital loans or private equity financing. For example, an e-commerce company may need quick working capital to purchase more inventory if it suddenly gets a lot of demand for a certain product.

Plans with the funding

Some of Jenfi’s Series A will be used to develop more integrations for its proprietary risk assessment engine. This analyzes how efficiently companies use their growth spending. Currently, it can tap into information from bank accounts; software like Xero or Quickbooks; payment gateways including Stripe and Braintree; e-commerce platforms like Shopify, Shopee, and Lazada; and Facebook Ads and Google Ads.

Ultimately, Jenfi’s plan is to move beyond financing and also provide tools to help businesses. “We see ourselves as partners in our portfolio companies’ growth,” said Liu.

Since Jenfi taps into a mix of data sources — including bank accounts, accounting software and digital advertising platforms, it can use that same information to identify opportunities. Part of Jenfi’s Series A funding will be used to develop automated analytics. For example, the platform would be able to identify an advertising opportunity with high ROI on Google Ads and notify the company, asking if they want to apply for more capital to finance the campaign.