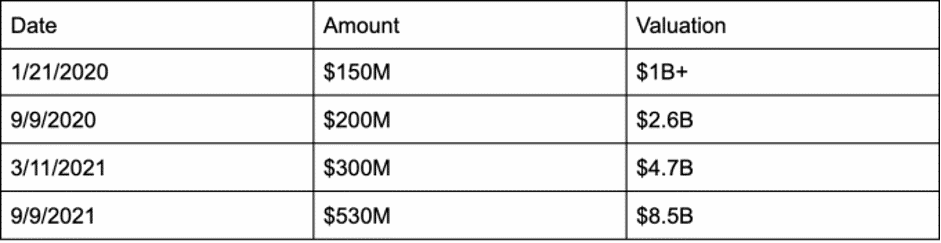

Snyk gets another investment of $530M as its valuation rises to $8.5B. It is a Boston-based late-stage startup that is trying to help developers deliver more secure code. Out of the $300 million in new money and $230 million in secondary funding, the latter part is to help employees and early investors cash in some of their stock options. The $8.5 billion valuations were up from $4.7 billion in March when the company raised $300 million.

Investors present at the round

The long list of investors includes an interesting mix of public investors, VC firms, and strategics. Sands Capital and Tiger Global led the round, with participation from new investors Baillie Gifford, Koch Strategic Platforms, Lone Pine Capital, T. Rowe Price, and Whale Rock Capital Management. Existing investors also came along for the ride, including Accel, Addition, Alkeon, Atlassian Ventures, BlackRock, Boldstart Ventures, Canaan Partners, Coatue, Franklin Templeton, Geodesic Capital, Salesforce Ventures, and Temasek. This round brings the total raised in funding to $775 million, excluding secondary rounds, according to the company. With secondary rounds, it’s up to $1.3 billion, according to Crunchbase data. The company has been raising funds at a rapid clip.

Inorganic growth with the investment money

Snyk CEO Peter McKay says that the additional money gives him the flexibility to make some acquisitions if the right opportunity comes along. The companies often refer to this as “inorganic” growth.

“We do believe that a portion of this money will be for inorganic expansion. We’ve made three acquisitions at this point and all three have been very, very successful for us. So it’s definitely a muscle that we’ve been developing,” McKay said.

The company started this year with 400 people and McKay says they expect to double that number by the end of this year. He says that when it comes to diversity, the work is never really done, but it’s something he is working hard at.

The CEO of Snyk on diversity

“We’ve been able to build a lot of good programs around the world to increase that diversity. Moreover, our culture has always been inclusive by nature because we’re highly distributed. I’m not by any means saying we’re even remotely close to where we want to be. So I want to make that clear. There’s a lot we still have to do,” he said.

McKay says that today’s investment gives him added flexibility to decide when to take the company public because whenever that happens it won’t have to be because they need another fundraising event. “This raise has allowed us to set up with strong, highly reputable public investors, and it gives us the financial resources to pick the timing. We are in control of when we do it and we will do it when it’s right.”