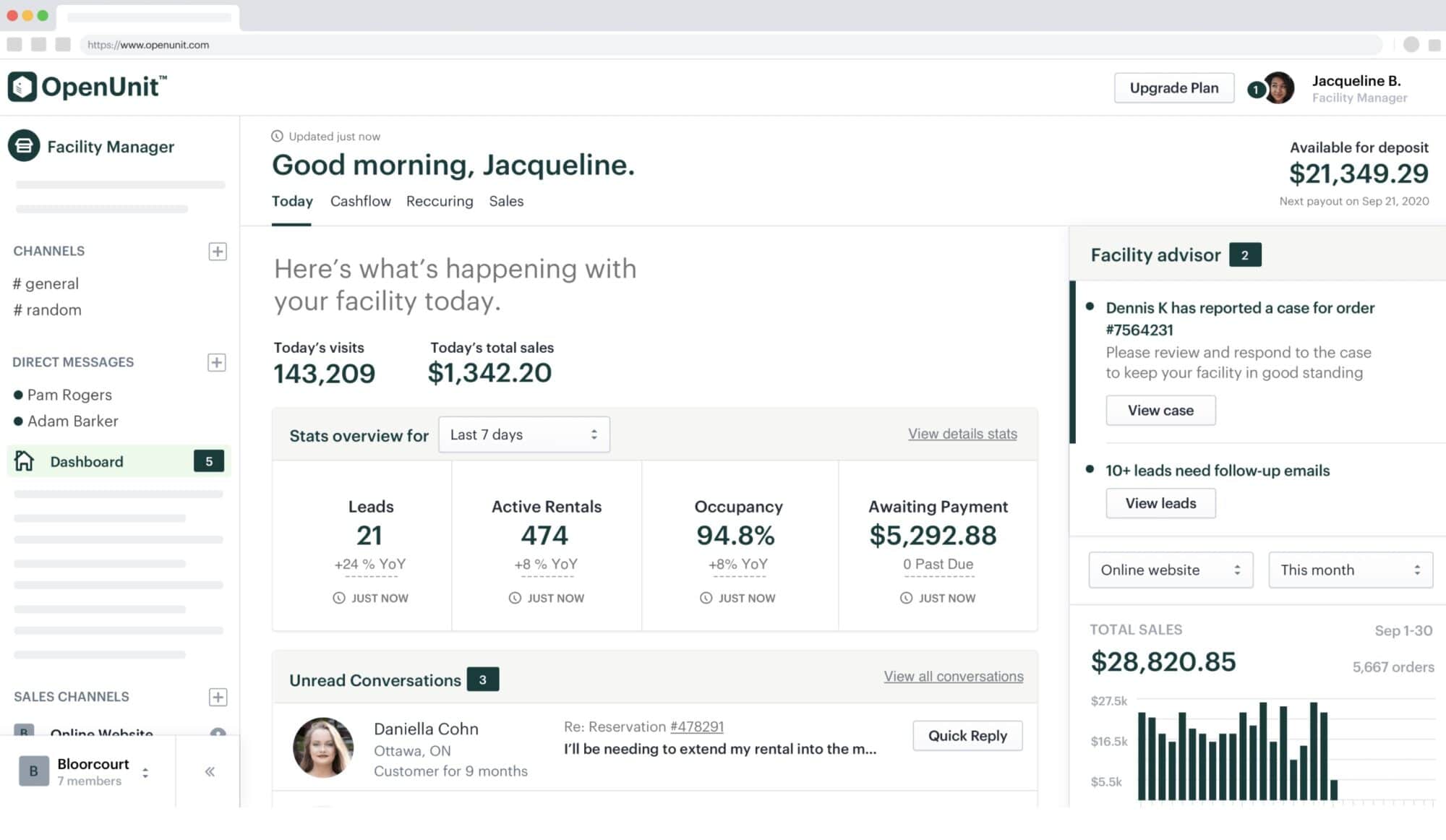

OpenUnit is a startup that gives the needed technology to the mom-and-pop stores to help them keep up with the giant chain stores. Self-storage companies now move their services like rentals, leases, and payments online. Hence, it’s becoming increasingly difficult for them to ‘know’ their customers. Its integration into the business is a way to help self-storage operators bridge the gap between their online and in-store customer experiences.

The idea, the fundings, and the expansion

The small stores bring the storage units, OpenUnit brings the website, payment processing, and backend tools needed to manage them. They don’t charge facility owners a monthly subscription fee. Instead, they take a cut of each payment as the payments processor.

OpenUnit has raised a $1 million seed round and acquired the IP of a fellow YC company along the way. They’ve been expanding to locations around the U.S. and Canada, and now have a waitlist of over 800 facilities. This round includes investment from Garage Capital, Advisors Fund, Insite Property Group, SquareFoot co-founder Jonathan Wasserstrum, and a number of angel investors.

Raising money and strategic partnerships as well

OpenUnit co-founder Taylor Cooney said that this seed round is about strategic partnerships as well as the money. Of the 20+ investors participating in the round, six are from the self-storage industry. This industry includes from prior/current facility owners to the director of the Canadian Self Storage Association. Some of them are investing for the first time in a tech or software company. But all potentially bring something to the table beyond money.

Of course, that’s not to say they’re just letting that money sit around. They’ve grown the team from just Taylor and Lucas up to five, and are still looking to grow. Meanwhile, the company has acquired the IP of fellow Y Combinator W20 batchmate Affiga. It is a product that automatically provides insights about a new customer after a transaction is made.

What’s next?

Their main aim is to get more people off the waitlist and onto the platform. They’re also exploring other opportunities, including potentially providing loans to facilities looking to expand or renovate. Being both a management platform and the payments provider, they have deep insights on how a facility is doing; they know how much a location makes, how punctual their customers are with payments, etc. So they can use that data and combine it up with insights on what improvements can increase revenue.