China’s startup sector has exploded over the past five years and currently ranks second only to the United States in terms of total venture capital raised, invested in, and departed (VC). More than 100 Chinese startups went public on international stock exchanges in 2017.

China startup culture added 34 new businesses to its list of “unicorns” (companies under 10 years old with a valuation of at least $1 billion) in 2018, bringing the total to more than 270.

Five variables have come together to cause this boom: favorable government policies, mature innovation ecosystems, the building of a critical mass of knowledge in particular industries, the growth of the middle class, and new technologies and business models with the potential to be revolutionary.

Corporates, both domestic and foreign, are interested in working with startups in China for a variety of reasons, including access to new technologies and innovations, the development of new ecosystems, the acceleration of growth through the use of outside expertise and resources, the creation of startup spinoffs, the amplification of investment through the use of outside resources, setting the bar in an emerging industry, and becoming the preferred provider of developing giants.

Things You should know about China’s Startup Culture

The Competition is Crazy

A good concept in the United States can inspire a few copycats. In China, virtually no restrictions apply. According to rumors, there are at least 100 distinct Android stores and up to 5,000 Groupon clones. Brutal strategies include purchasing reviews that are critical of rivals and blatant stealing of intellectual property.

Chinese Consumers’ Experience levels are Totally Different

Some Internet users in China have only ever used the most widely used instant messaging (IM) network, QQ Messenger, and have never ever SEEN an email message.

Creating a Business in China is a Nightmare – Rigid Chinese Government

You must create a network of subsidiaries in various nations to ensure proper funding flow, obtain an Internet Control License from the government, and create trusts for any employees to whom you intend to grant stock options if your business is foreign and you want to raise money in the United States.

There are many Technological gaps between Startups

You have to host everything yourself because there aren’t many trustworthy cloud connectivity providers like Amazon Web Services, Heroku, or Google Apps, and programmers are a technological generation behind.

Office Space Costs a lot of Money for Startups

The majority of Chinese IT professionals still choose to work for large organizations and prefer to be paid in cash rather than stock. Therefore, if startups don’t have a large, attractive workplace, potential employees will believe they don’t have good prospects and won’t apply to work for them. Both home offices and loading docks are unacceptable.

Ugly Websites Perform Better

By Western standards, most Chinese Web sites are unattractive and busy, yet research indicates that these sites have higher conversion and clickthrough rates than the sleek, tidy Web 2.0 sites that are popular in the U.S.

There is no opportunity for Outside Angel Investors

Nobody outside of their inner group is trusted, and money from Chinese sources is already flowing freely. Immersion in the culture is the only way to succeed.

The Reasons behind China’s Startup Expansion are Varied – Chinese Domestic Market

Chinese startup and innovation ecosystems have reached a critical mass of knowledge and resources after three decades of development. The Chinese government has implemented a number of preferential policies to assist and encourage startups since it sees “mass entrepreneurship” as the next phase of the nation’s reform and opening up.

Aiming to emulate successful founders like Alibaba’s Jack Ma, entrepreneurs have emerged as society’s new heroes. An increasing consumer class is looking for distinctive answers that address their demands and is prepared to pay for them.

Globally and locally, new technologies and business models with the potential to change industries are emerging. In contrast to industry and construction, services and consumption are now bigger contributors to macroeconomic growth.

Most Startup Investments are made by a group of Important Chinese IT giants – Chinese Tech Companies

Diverse ecosystems have converged around a select few important enterprises, as we found in our examination of corporate players in the Chinese startup environment. Tencent, Alibaba, Lenovo, Fosun, Baidu, JD, Xiaomi, Qihoo 360, and TCL are the networks that support the bulk of Chinese unicorns; they are also shown in the above diagram.

The development of the Chinese startup environment is significantly influenced by the strategic vision, robust infrastructure, and large financial resources of the Chinese tech titans. The investment behavior of the “backbone corporations” of the Chinese innovation ecosystem exhibits two distinct tendencies.

One is their international expansion: they are acquiring market shares in e-commerce, mobile payment and finance, and online-to-offline services through investments in businesses like Tesla, Snap, Spotify, and Flipkart.

The second is their desire to use internet skills in conventional businesses. Recent investments have been made in the logistics, retail, and healthcare sectors, among others. The giants have their eye on startups that successfully combine the “offline” and “digital” value chains.

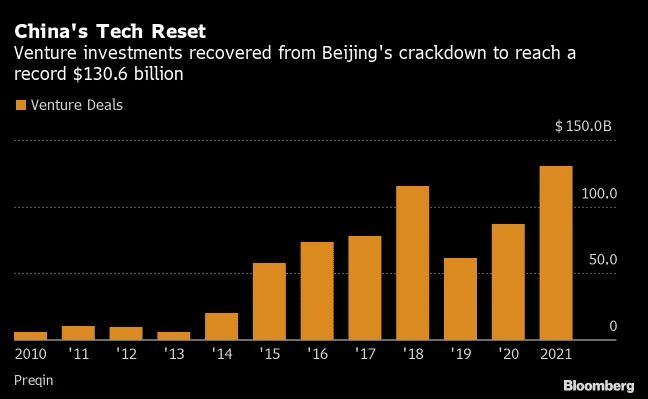

Chinese Businesses Take Advantage of the Dynamic Business Model Ecosystem – Venture Capital Investment

Cost innovation, speed in execution, scale-up and cloning, opportunity facilitation (rather than service provision), ecosystem-driven innovation, customer-centricity (even at the price of core competency emphasis), methods for reducing the need for trust, analytics-driven models, external capacity exploitation, and significant niche specialization are common business model components utilized by Chinese startups.

An excellent example is Xiaomi, a consumer electronics firm that sells hardware yet describes itself as an internet company. Xiaomi is recognized for its line of goods which includes smart wearables, appliances, and mobility devices.

The firm charges nearly no margins on its mobile phones, according to the company’s former CTO, and its TVs, which utilize the same screens as higher-end models, retail for substantially less than their rivals’ products.

By purchasing a minority stake in a few OEMs, the corporation taps into China’s large manufacturing ecosystem in order to move quickly and reduce the financial risk associated with the failure of any one device.

Following multiple design revisions, chosen goods are given smart capabilities to connect the gadgets to the company’s web platform.

This strategy, which fuses the distinctive advantages of China’s hardware industry with reasoning from its online economy, has produced Xiaomi as one of the few businesses in the world with the profitable claim of completely supplying the smart home – while obviously reaching beyond it.

Engaging startups is a key tactic for managing the business environment’s fast change, both from a sales and innovation standpoint and by utilizing outside technology and business models.

Conclusion – china startup culture

China’s startup culture is all about money and it is the reality, because there is insane market competition, and without money, you cannot survive in china. If you are planning to open your business in china, then make sure you have the sources to survive there.