The majority of individuals don’t begin to consider taxes until January. But if you own your own business, you have a lot more responsibilities than the ordinary individual such as self-employment taxes, employee taxes, and quarterly estimated taxes. It’s a lot.

That is a lot. You should always be thinking about how to handle your tax deductions properly. In light of this, here is a complete guide for managing taxes as entrepreneur to handle and lower their tax obligations for more business profits.

Be Prepared for the Future

Tax season is not just a time to “filing taxes,” but also to lay the groundwork for good money management & count business expenses. Here are some pointers to assist you in laying that foundation.

Money & business expenses problems are a challenge for many business owners. If you asked a techie about accounting or taxes, they would stop working and write code all night. The fundamentals of financial management, such as setting up the proper accounting system & business structure, can be introduced to you through tax filing.

This enables you to handle billing, collections, and creating financial reports to run your business in addition to enabling you to “click a button” to submit your taxes the next year timely & reap tax benefits.

No need to work this out on your own; just ask a buddy with an experience in tax and finance, a consultant, an outsourced CFO, or someone else. Even if it’s simply to file your taxes, there are many professionals that can help.

Every company needs a fundamental accounting program. If you don’t believe me now, you will when it’s time to file your taxes. Which of these best describes you? You assemble together your tax return using receipts, bank statements, phone records, and credit card statements.

Alternatively, your accounting software may allow you to “click a button” to produce your financial statements. Use tax season as a justification to purchase financial management software if you haven’t already. The top receipt app for tracking your spending for tax purposes may also be of interest to you.

Many small enterprises experience financial losses in the early years of expansion. These losses, often known as Net Operating Losses or NOLs, may be carried both forward and backward.

This enables you to lower taxes in the years you generate money by offsetting these NOLs against income. For assistance in utilizing these to lower your taxes, speak with your CFO or other financial contacts.

Filing Process Management

Here are some advises for navigating the tax filing process:

Don’t try to accomplish this on your own; rather, use an accountant or tax preparation services. These professionals and services have already completed those tasks.

You should file online if you want to be certain that your tax return will be received on time. Once your tax return has been properly received by the IRS, you will receive a confirmation # when you e-file.

This is a far better option than mailing your return and not knowing if it will ever be received. An electronic tax return will be handled more quickly than one that is mailed in if you are anticipating a refund.

Many independent contractors run their businesses as sole proprietorships with no official separate legal body. Alternatively, they can choose a single-member LLC, which is regarded as a “disregarded entity” until they want to be taxed as a corporation.

Your individual income tax return, Federal Form 1040, Schedule C, will list your net business income in both scenarios. The 2016 Form 1040 must be submitted by April 18, 2017, although this date might be extended until October 15.

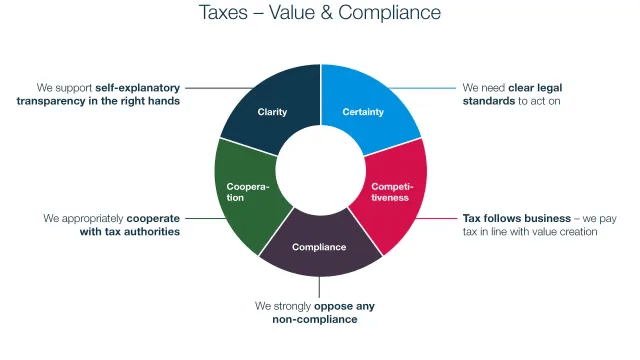

Follow the Rules and Take Advantage of Breaks

Small businesses have several options to benefit from the most recent tax write-offs. However, you must ensure that you are carrying them out correctly and in accordance with the most recent laws. Here are some pointers to assist.

Costs associated with organizations and startups are deductible up to $5,000. Every dollar above $5,000 needs to be capitalized and amortized.

Claim premiums as a deduction if you have an individual health plan and pay premiums without receiving any tax cuts or subsidies. You must possess 2% of the shares in an S corporation, LLC, single proprietor, or partnership in order to be eligible to claim this. Consider that you are a lone owner with a personal and business income of $60,000 in your state.

Around 30% of your income is subject to federal taxes. You can deduct up to $10,000 in health insurance costs for you, your spouse, and any dependents, lowering your total income from $60,000 to $50,000. You save paying almost $3,000 in additional income taxes as a result.

Rent for commercial leases is undoubtedly deductible, but what if you operate your business from home? Regular and exclusive usage of the home office is crucial. Add $5.00 to the square footage of your home office (up to 300 square feet), using the streamlined technique.

The maximum deduction allowed by this approach is $1,500. The more complicated, standard approach takes into account the area of your home that is set aside for an office.

To make your home office a comfortable location to work, you’ll need chairs and other furnishings. Even moving the leather chair you use at your home office into your living room at night is possible. This enables you to make improvements to your house while still deducting them from your taxes.

You might be able to deduct bank costs for your business accounts. The $3 charge can be subtracted, for instance, if you need cash to pay a delivery person and must use the ATM next door. Cash advance fees on credit card transactions are subject to similar deductions. All of them are regarded as reasonable and essential company expenses.

Actual automotive expenditures like petrol, maintenance, and insurance are deductible. However, if you use the automobile for both personal and professional needs, figure out what portion of the time it is utilized for business, then add that portion to the overall cost of the car.

For instance, if your automobile was driven a total of 15,000 miles and, according to your mileage tracker, 6,000 of those miles were for business, you would split 6000/15000 to get 40%. Consequently, you may write off 40% of your whole automobile expenditures as a business expense.

Conclusion

Maintaining taxes as an entrepreneur can be a daunting task. Since so many people can assist you, there is no need for you to become an expert. Use the opportunity to organize your finances, in light of the foregoing. More than you may realize, it will help you as a businessperson.