Change is the only constant, so is adaptability

In times of crisis, the startup world behaves on the rules of biology. As we once read that the survival of the strongest is not guaranteed, but the survival of the most adaptable is. And this held true in the past year when the pandemic drove many out of business and many more went into overdrive just by modifying their services from in-person to deliverables. They simply adapted.

Twisted times – predictions then and now

Venture capitalists also behave a bit like oracles. They imagine the future outcomes, make predictions about the course of action, and decide the fate of founders and startups. Usually, these prophecies take the form of cash. The cashflow shows where the capitalists are putting their bets. But occasionally, they also share the prophecies in the form of public writings. Venture firm Sequoia told its founders in a memo posted on March 5 “Coronavirus is the black swan of 2020”. “We suggest you question every assumption about your business.”

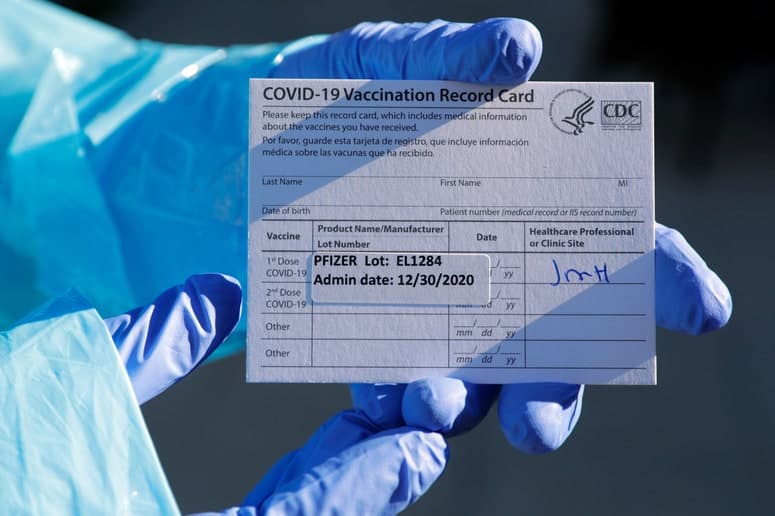

One year since the first worldwide lockdown, another change is underfoot. With millions of Americans getting vaccinated and states lifting restrictions around gatherings, people are preparing for a Great Reopening by summertime. This has led Venture capitalists to make new predictions. For example, Sequoia has sent out a new memo to all of its founders in recent weeks. It said, “Now is the time to start stepping on the gas.”

What exactly does the new memo mean?

Alfred Lin, a partner at Sequoia Capital says “The advice we’re giving founders is, in some ways, quite similar to what we put out a year ago: A lot’s changing, so seize the moment”. “But this moment is much more optimistic,” Lin says that the pandemic has remade consumer and corporate behavior in myriad ways; now is the time to make bets—and potentially fortunes—on which changes will stick.

Many VCs expect the immediate payoffs will be for startups in categories like entertainment and travel, sectors where people will want to spend their money post-vaccine. At the same time, Lin says, “we want to build a decade-long company, so we have to focus on things that endure, not things that are fads.”

Relation between Vaccination and financial comebacks

Kim-Mai Cutler, a partner at Initialized Capital, an early-stage venture firm says “There are huge markets to seize right now”. Some of those markets experienced growth during the pandemic, like grocery delivery. Instacart, which Initialized has invested in, saw a 500 percent increase in orders in the first half of 2020—and while it’s unlikely to keep all of its pandemic customers, it probably will keep some of them.

Other markets will see more benefits as the vaccinated population grows and there’s a return to pseudo-normalcy. “There are definitely companies in our portfolio that had their businesses put on pause for the year that has been basically laying the groundwork to come back,” says Cutler.